$37.7MM

Equity Invested (as of 10/31/24)

Statistics

- Open-Ended General Partner (GP) Fund

- Asset Type – Diversified Holdings (Hospitality/Multifamily/Mixed Use)

- Targeted Return 16-18% IRR

- Target Equity Raise – No Limit, Open-Ended

- Unit Price starting at $50k, then adjusted quarterly with Net Asset Value (NAV)

- Initial 3-year holding period, flexible exit thereafter

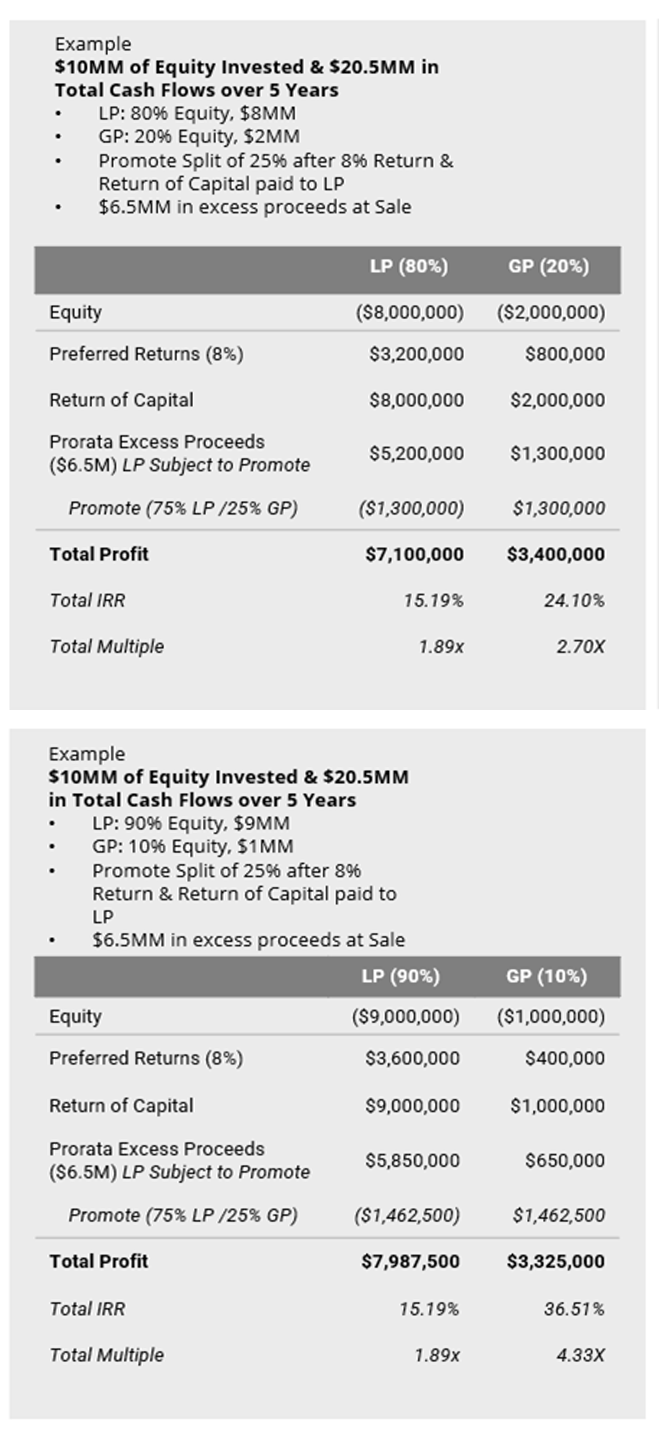

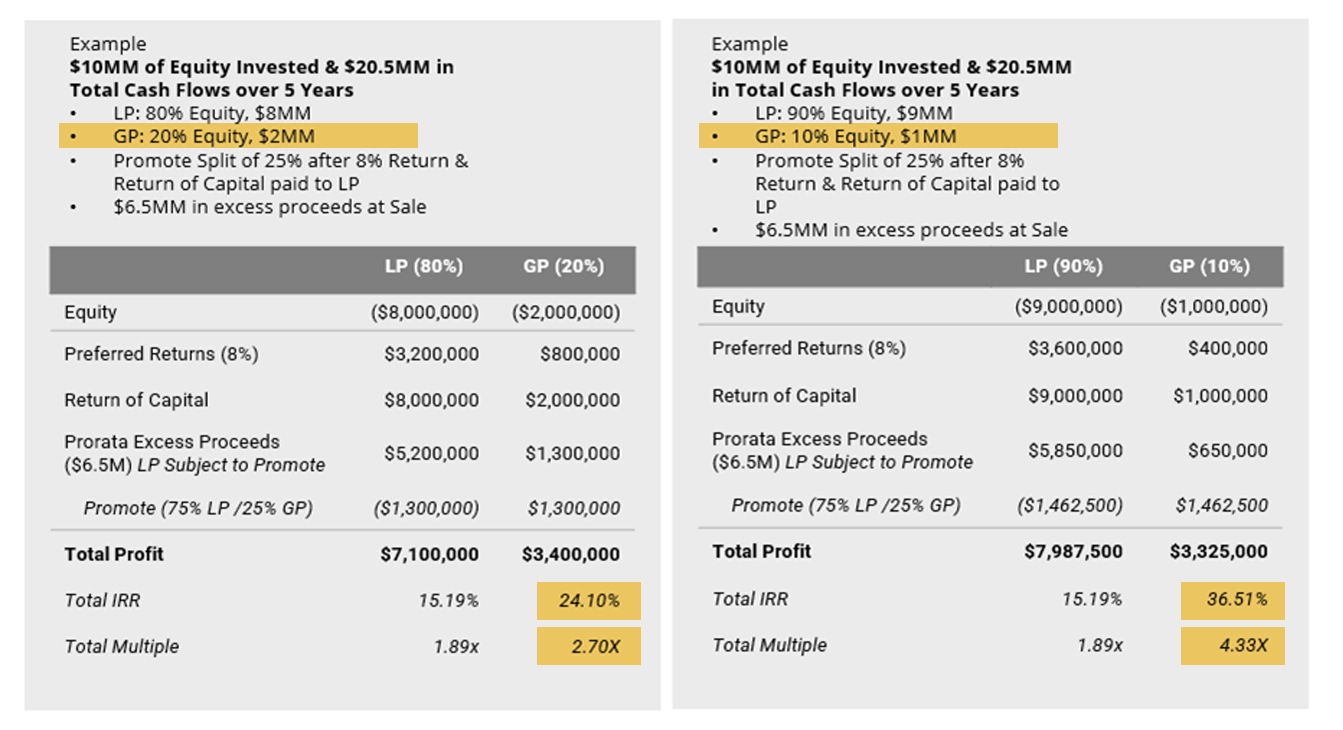

The Power of GP Promote

By taking a smaller General Partner (GP) equity position in several assets, Midas Real Estate Partners is able to diversify its investments while earning more of the upside.

The Power of GP Promote